Third quarter 2021: A letter from Kjell Inge Røkke and Øyvind Eriksen

Dear fellow shareholders, Aker's positive development continues. At the end of September, our net asset value (NAV) reached a new record of NOK 70.8 billion, up from NOK 66.9 billion at the end of June. To strengthen our development further we are establishing Asset Management as a new business area.

To read the Norwegian version of the shareholder letter, please click here.

Before we discuss our ambitions and plans for the future, we start with a status update on the third quarter. It is 25 years since Aker and RGI merged, and since TRG become the majority owner. It is therefore natural that we mark this occasion by taking a deeper view on both our history and our plans for the future.

Aker creates shareholder value through active, industrial ownership and transactions. It has developed rapid-growing industrial companies such as Aker BP, Aker Horizons and Cognite.

The industrial portfolio contributed a value increase of NOK 4 billion in the third quarter. Year to date, as of the end of September, our NAV has increased by 33 per cent. The investment in renewable energy and green technology has, in just a short period of time, made Aker Horizons our second most valuable investment.

The industrial portfolio is the focus of Aker's financial and industrial development. Through the portfolio, we manage opportunities and partnerships that develop technologies, projects, organizations and business models that create value quarter by quarter. An example of this is our recent entry into offshore salmon farming through the collaboration with SalMar in SalMar Aker Ocean.

A new initiative is our establishment of a competence center for green industrial initiatives in Narvik. The region has good access to renewable energy, great transport connections and a local community that demonstrates climate leadership. As part of Aker's investment in industrial software and industrial technology, we will, together with the region's electric utility company, Nordkraft, build and operate a data center. Aker Horizons will invest in property and companies as a platform for innovation and the launch of businesses in hydrogen, green steel, battery production and potentially new CCS projects for external customers.

We build companies for the future based on our core competences. Knowledge-driven industrial development, a unique ability to rapidly respond to changes in society and the markets in which we operate and cooperation between companies, local communities, engineers, and skilled workers are all a common thread since Aker was established in 1841.

Through 25 years of TRG's active ownership, Aker has continually reinvented itself. The sale of Ocean Yield to KKR is the most recent example of this and will release NOK 4.5 billion in proceeds, which Aker can reinvest in existing and new businesses.

Our goal is to make a difference. History shows that our active ownership adds extra value to shareholders. As an organization of employees and companies Aker generates value in excess of the main index on the Oslo Stock Exchange and other benchmark indexes. Measured in both NAV and total shareholder returns in the form of share price development and dividends, Aker is well above benchmark indexes since the company was re-introduced to the Oslo Stock Exchange 17 years ago.

In meetings with investors and business partners, we are often asked what makes Aker unique. Our answer is the combination of entrepreneurial spirit and deep industrial knowledge built up through several generations. Our ownership structure provides predictability through good and bad times. It provides us with fast and effective decision-making, the ability to exercise active ownership based on deep industrial knowledge and experience, extensive transaction expertise, robust organizations and Aker's ecosystem of companies, networks, and partners. Together this creates a unique competitive advantage, which is central to the creation of long-term added value.

With this foundation we attract skilled employees, capital, and a vast pipeline of business opportunities.

This year marks 25 years since TRG became the main owner of Aker. We are both tightly connected to Aker's development. Through this period Aker’s DNA has remained constant, while our portfolio of companies has been continually evolving to create a rich, synergistic ecosystem of human and organizational capital.

The merger between RGI and Aker was approved on the 21st November 1996, and at it was clearly stated that: "The goal of the merger is to create a strong Norwegian-based owner company."

This goal of the merger is fulfilled. But the development has never been a linear trajectory. In 2000, TRG delisted and took Aker private. Later, it became apparent that the rescue operation of Kvaerner would result in some challenging years for Aker.

Early 2004 marked the start of a process to restructure the Norwegian supplier industry, offshore shipyards and shipbuilding whilst retaining Norway's leading engineering competence from Aker and Kvaerner.

As part of the restructuring, Aker was re-introduced to the Oslo Stock Exchange on the 8th September 2004. When Aker made its "comeback" on the stock exchange, its NAV stood at NOK 7.5 billion. Today, it is almost 10 times higher, and since its re-listing has paid-out dividends equal to NOK 16.7 billion.

Aker’s NAV has increased at an average annual growth of 21 percent per year. Measured in share price development and dividends, the return to shareholders has averaged 26 percent per year. The main index on the Oslo Stock Exchange (OSEBX) has returned about half of this over the same period.

And over the past 10 years, Aker has been evolving constantly, with Aker and Aker-controlled companies completing acquisitions and transactions with a total value of over NOK 125 billion.

Expertise from oilfield services and engineering in Aker Solutions was vital when building an oil company. Aker BP has grown from close to zero into a company with a market value of about NOK 120 billion in just a few years. On the shoulders of Aker, Aker BP and Aker Solutions, we have built Cognite, Aize and Aker Horizons. In a short period of time, we have taken an internationally leading position in industrial software and established solid growth platforms for fast-growing areas in renewable energy and green technology.

During the corona pandemic the transformation of Aker accelerated. Over the course of the last 15 months, Aker Horizons has already become a valuable growth platform in offshore wind, onshore wind, hydrogen, CCS, hydro power, solar energy and, in the future, battery production as well.

Across the Aker group, we are experiencing higher activity than ever before. We see many exciting business opportunities ahead, both with our 13 publicly listed companies, and outside the stock exchange arena, where Aker is the largest owner in companies such as Cognite, Aize, Abelee, Seetee, Just Technologies and Aker Property Group. We facilitate a unique network of highly skilled employees and independent companies. This allows for a distinctive climate for cooperation, enthusiasm, and strong corporate governance, where leaders and employees are empowered to act, and new commercial opportunities are realized.

The Aker universe of companies has become a well-functioning ecosystem. As part of this universe, we collaborate with leading experts across a wide range of fields. Some examples:

In Cognite, Aker works with two of the world's top technology investors, Accel and TCV, to further develop industrial software. Cognite, for its part, collaborates globally with world-leading technology companies such as Microsoft and Accenture. BP and Aker are partners in the development of Aker BP, and the company is at the forefront in using technology and digital tools for oil and gas production to realise the lowest possible emissions and cost per barrel. Aker BP's alliance model with supplier companies has aligned incentives to improve and deliver quality according to budget and plan. Together with various partners, Aker Property Group has developed several real estate projects at Fornebu. Aker Offshore Wind collaborates with Statkraft, BP and Ocean Winds on offshore wind on the Norwegian continental shelf. Yara, Statkraft and Aker Clean Hydrogen have established a joint company for the production of green ammonia at Herøya, Norway. And SalMar and Aker combine expertise and capital in offshore fish farming through SalMar Aker Ocean.

The list of attractive partners is much longer but the point is that cooperation enables us to further develop our industrial portfolio and financial investments.

This is what we experience at “Akerkvartalet” at Fornebu, which is the head offices of Aker and its operating companies, and which has become a breeding ground for creativity and collaboration. Akerkvartalet is expanding its office space with Aker Tech House, which is under construction, and will host another 2 000 employees.

The world is changing rapidly, and Aker will utilize its key advantages to position itself for the future. Strong forces are altering the behavior of people and businesses. We are affected by climate change, geopolitics, inequality, lifestyle and health, and not least technology that touches every part of our modern lives.

In recent years, these changes have been strongly influenced by falling interest rates, exponential growth in computing power and the exploding number of digital devices. Consumer technology has changed markets and business models, and the consumer wave continues to evolve and disrupt yesterday’s business models.

Think about the impact of the smartphone. In January 2007, Apple’s Steve Jobs unveiled the first iPhone, which combines three products into one: a telephone, a music player and an internet communication tools. The smartphone, and especially the iPhone, has touched and transformed many aspects of our everyday lives.

We’re now standing at an inflection point in the disruption of heavy industries. Smart minds, programmers and industrial software combined with domain knowledge, will enable us to drive down emissions and reinvent products and work processes to ensure a transformation in cost and resource-efficiency in industry. This provides new value creation opportunities for those who can adapt to the changes.

The change is happening faster than most people would have dreamed only a few years ago. The level of digital knowledge among mankind and machines is rising rapidly. Some 90 percent of the information available online was unavailable or did not exist even a few years ago.

The era we have embarked upon is centered around human capital - how talented people will use their abilities to make a difference in solving the greatest challenges we face today and building the companies of the future, creating jobs and value. With continued low interest rates, there will be good access to capital to realize new ideas and projects.

Norway is probably the only country in the world that has had such a large portion of its talents allocated to the oil and gas industry. This talent base has created an even larger portion of the innovations in the industry, which have made it possible with safe and effective hydrocarbon production around the world. Now the time is ripe for this talent to be reallocated to new challenges and opportunities. Norwegian companies have a promising, and potentially world-leading, basis for seizing and driving the transition to green energy.

These changes will be driven in ecosystems and companies where innovation isn’t organized as a cost center.

Norwegian industry and the Aker companies are well positioned to face the future. At Aker, we have excellent domain knowledge in oil, gas, offshore construction, renewable energy, seafood, and marine biotechnology. This knowledge combined with industrial technology, software and automation will shape the years to come. Many new companies will emerge, and some will disappear. 25 years from now, the top 10 list of Europe's and Norway's largest and most valuable companies is likely to consist of company names that we have not heard of or barely know today.

Aker's DNA is developing new industrial leaders through utilizing our deep domain knowledge build up over generations and our ability to drive value-creating transactions We are pleased with our positive industrial and earnings development so far. At the same time, we recognize that the number of opportunities that come our way exceeds our capacity. This is especially true within industrial software, industrial technology, and green infrastructure, which are relatively new segments in Aker's portfolio. In addition, we realize that our ability to create shareholder value through transactions can advantageously be institutionalized to become more scalable.

The industrial portfolio currently accounts for 90 per cent of Aker's assets. Going forward, the percentage of the industrial portfolio may decrease due to reallocation, sales and growth in new areas. For shareholders, the total portfolio value development will be more important than the individual companies in the portfolio.

To put it into perspective: Today, Aker BP, Aker Horizons and Cognite account for approx. 75 percent of Aker's assets. Our three most valuable companies are newcomers. Today’s Aker BP was in its infancy 15 years ago and a key milestone was the merger with Det Norske in 2009, while the acquisition of Marathon Oil Norge in 2014 was a "company maker," and its breakthrough was the merger with BP Norway in 2016. Cognite is less than five years old, and Aker Horizons was established in July last year.

It’s time to think and act anew. If we could skip 10 years into the future, there will be new companies and businesses that define Aker. Much of the future could well lie in what has little economic value today or is only at an early phase in its development. Our task as industry builders is to use Aker's industrial DNA to ensure good access to opportunities and capital, and importantly good access to people with the right ideas. In this way, Aker facilitates industrial development and long-term value creation.

In practice, Aker is an active asset manager with an industrial base. At the end of the third quarter, Aker managed assets worth NOK 84 billion, and is the largest owner of 13 listed companies and private companies with a total value of more than NOK 200 billion.

The direction is clear. Long-term industrial development and active asset management go hand-in-hand. Going forward, we will grow and strengthen the capital base to realize new opportunities and provide even greater opportunity for active ownership. Aker will still play in the top division in Norway, but we have ambitions for both Aker and many of our companies to take a larger role on the international stage.

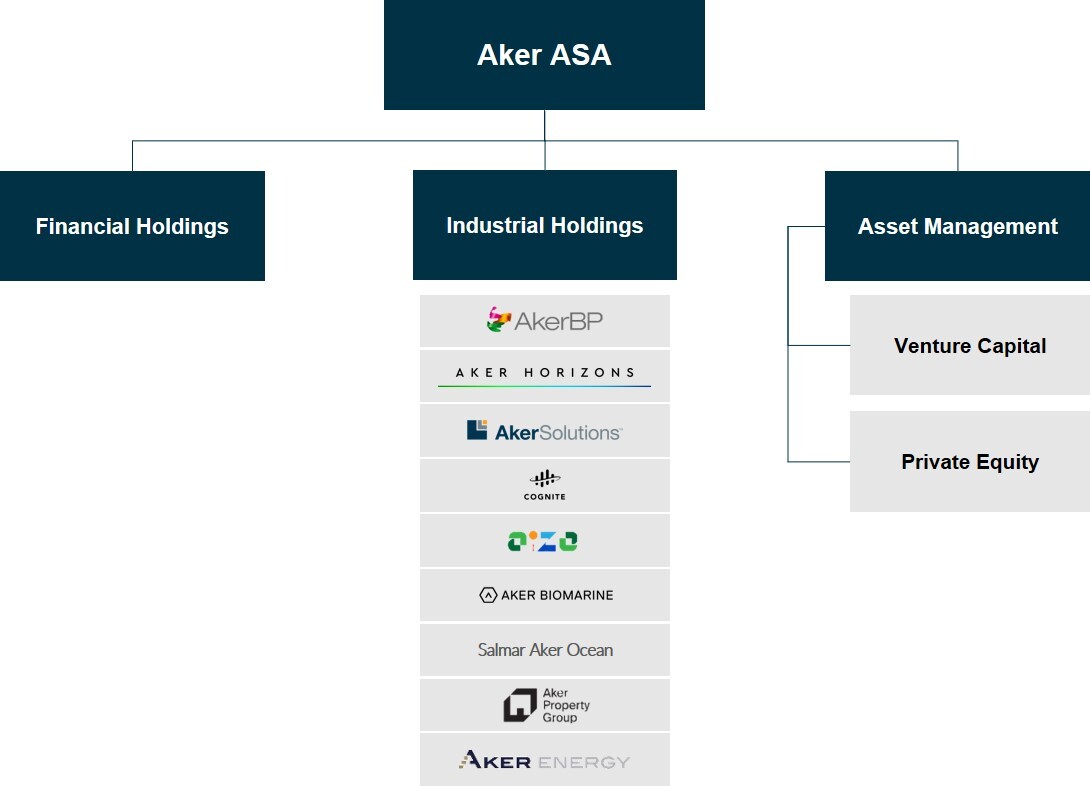

With this backdrop, Aker has taken its first steps towards managing third-party capital through a fund structure. Aker is now establishing active asset management as a new business area with Aker Venture Capital and Aker Private Equity as the first initiatives.

(text continues after illustration)

Our rationale for this can be summarized in a few main points. We are continually exposed to a vast range of business opportunities and access to expertise and capital will enable us to scale up our ability to execute on these opportunities. We will be able to complete more transactions and projects with both private and public capital. We are open for collaborating with new partners and widening our base of investors. In sum this will enable us to create value for shareholders and recurring cash flows for Aker.

We already have the key personnel in place for these new platforms. As part of Aker Private Equity, we will establish OrbeNovo together with Co-Founder Khash Mohajerani, where BP’s former CEO Bob Dudley will take on the role as Chairman of the Board. Aker’s Investment Director Martin Bech Holte will lead

Aker Venture Capital and Investment Director Lene Landøy will lead Aker Industrial Holdings, which will form the center of our organization.

The new organizational structure of Aker aims to strengthen Aker’s industrial and financial position further. The breadth of Aker’s current opportunities requires us to connect expertise and capital together in new constellations. An example of this is Aker Horizons’ initiative to establish an Energy Transition Fund, together with an anchor investor. This kind of fund structure acts as a financial partner, which enables us to realize opportunities and industrial projects that are beyond our companies’ current capital capacity.

We see similar opportunities and needs across many other areas in Aker’s portfolio, including venture capital and private equity. The combination of the right expertise and the right capital can enable us to realize more opportunities than our current capital structure allows.

We envisage that the new business areas will be organized into fund structures where each fund has its own capital base and partnership. The decision to establish partnerships at several levels is an important part of our development in the coming years. This will align incentives and with the right expertise drive behaviors and discipline towards a common goal, in addition to making it more attractive to recruit new talent. We aim to create a dedicated organization with partners (de-facto co-shareholders), who are experts within the respective mandate and decision-making processes that meet the requirements that future external investors in the funds will expect.

The model for financing industrial development and value creation will be based on a decision-making process that safeguards independence and integrity. Potential conflicts of interest and transactions involving related parties must be handled and treated carefully and professionally.

In recent years we have completed several transactions between Aker-owned companies that have been executed in a manner that has created value for all shareholders in the companies involved. Our experience is that there lies an enormous potential at the cross-section between companies, and under the right conditions and in the right hands this value can be realized. Openness, independence, and transparency are important prerequisites.

Aker already has an extensive network, and in the future, we will continue to expand this network with significant knowledge and expertise from asset management, capital allocation and establishing PE-funds. This will certainly affect how we take our next steps in asset management.

Venture Capital will be organized into a stand-alone company and partner model with three vertical fund structures initially: Early-stage investments, industrial software, and industrial technology.

Aker has already demonstrated success with investments in venture capital. Cognite, Aize, Abelee, Seetee and Just Technologies are recent examples. Our ambition is now to take our venture capital investments to the next level, where in the first phase this will be financed with Aker’s own capital. Once we have established a solid framework we will invite in external capital.

We have already announced that together with Tor Bækkelund, we are establishing RunwayFBU for "start-up" early phase investments in software and technology companies. The first fund is NOK 300 million. In addition, Axis will be established to invest primarily in software companies specialized in industrial data that are at a later growth stage. Our close partner and Cognite CEO, John Markus Lervik, will be closely involved in building up Axis. Aker’s investments in the fintech companies Abelee, Just Technologies and Seetee will be included as part of the venture capital structure.

Clara Venture Labs will be established as our platform for venture capital in industrial technology. We have already put in place a strong team under the leadership of Bernt Skeie, who comes from Prototech, a company which Aker acquired earlier this year. In addition to companies that originate from Prototech, the newly acquired Abalonyx, which is changing name to LayerOne, will be the foundation of the first Clara Fund.

Both RunwayFBU, Axis and Clara will initially be funded by Aker. In the future, it may be relevant to invite external parties to invest in funds where Aker's share as a rule of thumb will be approx. 25 percent of the total capital in each of the funds.

In a similar manner, we have taken our first steps within Private Equity (PE). This asset class has emerged as an increasingly important part of active international asset management. PE has several similarities with Aker as an industrial investment company, including the use of transactions, optimized capital structures and active ownership as tools for value creation.

The PE company OrbeNovo, which means “the new world” in Latin, will be established in London. Mohajerani, with the appropriate sounding first name Khash, has been a partner in the renowned PE management company Bluewater, and we were impressed with him during his role as a board member of TRG Energy. Bob Dudley, who played a key role in establishing Aker BP will take the Chairman role in OrbeNovo.

Bob Dudley was CEO of BP in a challenging period for the company from 2010-2020 and is now recognized as one of today's great industry leaders. Bob also has a central role in Aker's recent history. Together with BP's current CEO, Bernard Looney, it was Bob who was behind the merger that created Aker BP in 2016. No single transaction has created greater shareholder value and such ripple effects in the industry during the time we have been involved in Aker. Bob means a lot to us; therefore, we are grateful and excited for the opportunity to collaborate with him again, now to realize the PE opportunity in Aker.

OrbeNovo will have a broad investment mandate that, among other things, embraces companies in fast-growing industries. Aker will be the anchor investor in the first fund.

In addition to the establishment of OrbeNovo, Aker has given Converto a mandate to develop Aker's values in Akastor, Philly Shipyard, American Shipping Company, Solstad Offshore, Norron and some smaller investments. These are companies that have been part of Aker's portfolio for several years, but which will now benefit from Converto's even more focused ownership. Aker's former CFO and current deputy chairman of the board, Frank O. Reite, is the main owner of Converto. It will in practice be operated as an independent fund with Aker providing 100% of the LP capital.

Aker ASA in its current form was listed on the Oslo Stock Exchange in 2004. For 17 years, there has been a couple of minor mergers, but no equity issues.

We are keenly focused on crystalizing and creating value in a way that serves the shareholder community. Over shorter time horizons it can be optimal to not alter our capital structure through sale of controlling ownership posts when our analysis and investment thesis support strong underlying value creation over the longer term. But over the long term our task is to manage capital, which all our shareholders own, in an optimal manner.

A little "Food for thought" to those who like numbers and math: Aker's NAV was NOK 70.8 billion at the end of the third quarter, and at the same time Aker's market value was NOK 51.4 billion on the Oslo Stock Exchange. The total value of Aker's listed shares was NOK 68.7 billion. At the same time, it must be emphasized that a large share of Aker's value creation lies in the added value of our unlisted companies such as Cognite, Aize and Aker Property Group. As an example, the cost price for our ownership interest in Cognite was NOK 42 million at the end of the third quarter of 2020, while the value at the end of the third quarter this year, was NOK 6.7 billion after Accel and TCV entered as owners.

At the same time, Aker has a solid financial position with net interest-bearing debt of NOK 7.9 billion at the end of the third quarter, which constitutes a "loan-to-value" of 10 percent. In the fourth quarter, Aker will release NOK 4.5 billion from the sale of its controlling stake in Ocean Yield in accordance with the binding agreement with American PE investor KKR. Adjusted for this expected release of capital at the end of the third quarter Aker’s net interest bearing debt is NOK 3.4 billion.

KKR will pay a premium of 26 percent over the last closing price of Aker's portfolio company. A premium 25-30 percent above the share price is seen as a normal range when buying listed companies. In the event of a sale of a "share block" in a listed company, on the other hand, the price is normally around 5-10 percent lower than the last share price.

To continue this thought experiment: let us for example assume that Aker sells 80 percent of its large ownership stakes in listed assets for a strategic premium of 25 percent. This represents a value of approx. NOK 13 billion. In addition, if we assume that the remaining 20 percent of our portfolio of listed assets is sold at a 5-10 percent discount to the share price at the end of Q3 2021 – then this represents a loss in value of approx. NOK 1 billion. In sum the implication is a total of NOK 12 billion in additional value beyond the approx. NOK 20 billion in discount to Aker’s underlying values that is not priced into Aker’s shares.

The calculation can of course be discussed, and it can be argued that values are higher or lower. Most companies are convinced that they have pockets of hidden value. But remember that Aker is an investment company where 80 percent of the values are significant ownership positions in listed companies. The point is that we have the opportunity and potential to unlock value. The question is how we can optimize our capital structure and the companies we own, and not about short-term gains in the stock market. In Aker we have an industrial DNA that we do not intend to lose.

So why is Aker on the Oslo Stock Exchange? The company has never issued new shares or used shares as a means of settlement for transactions. TRG has never sold a share. For investors who buy and sell shares, gains can be realized as a "speculative value" with the right market timing.

Investors challenge us on what measures we want to implement to crystalize the underlying values. Repurchase of our own shares is something that is often mentioned but this is not considered an attractive option, as it reduces the liquidity of both the share and the company, limits the flexibility of the company, and increases the financial leverage.

Taking Aker private through a voluntary offer and then compulsory redemption is not an option for TRG.

One possibility would be to merge with a partner or an external company that prices Aker based on its underlying values inclusive of the growth potential we believe lies in our investments. This would give all shareholders an uplift in value, and a platform for future value creation.

Aker has traditionally been at its best in creating value over the long run, but we also have the capacity to perform and collaborate with the best PE players over shorter time horizons. A strategic collaboration with PE companies on smaller or larger sections of our investments is something we shall consider.

To return to where we started and the recently announced green industrial investment of Aker and Aker Horizons in the Narvik region: We were invited by the municipality to collaborate on the development of industrial activity by refining and converting competitive and clean hydropower into green jobs and sustainable export industries. We would never have had this opportunity if Aker was a pure PE and asset management company. The combination of Aker's long-term commitment, access to resources, adaptability and drive makes this possible. And as an industrial locomotive, Aker will attract private and public partners and suppliers.

To turn these plans into reality in Narvik, more than NOK 50 billion will probably have to be invested. It is not possible to achieve this without combining industrial ownership with access to the right type of capital on competitive terms. Our entry into active asset management allows for that. Aker will tie this together holistically. For Aker, the Narvik investment will be a prototype of the Aker of the future, where active asset management gives us the opportunity to take an even bigger step as an industrial developer.

In the meantime, we continue the processes and work to firm up Aker's new direction and plans for value creation. Aker will continue to be one of the most transformative and value-creative companies in Norway.

As always, we are open to good input and suggestions that can make Aker even more dynamic and relevant for the next 25 years. Historically we have been at our best when building our own companies. In the future we will be focused on building and developing companies together with others and having an even greater focus on the capital that we are managing.

Together with partners, co-shareholders and new investors, we will build the future on Aker's unique competitive advantage, where our entrepreneurial culture unites industrial development and capital in a new and value-accretive manner. TRG will continue as owner in an active ownership ecosystem that will create value, innovation, growth and provide predictability.

Kjell Inge Røkke, Chairman of the Board and majority owner

Øyvind Eriksen, President & CEO and minority shareholder